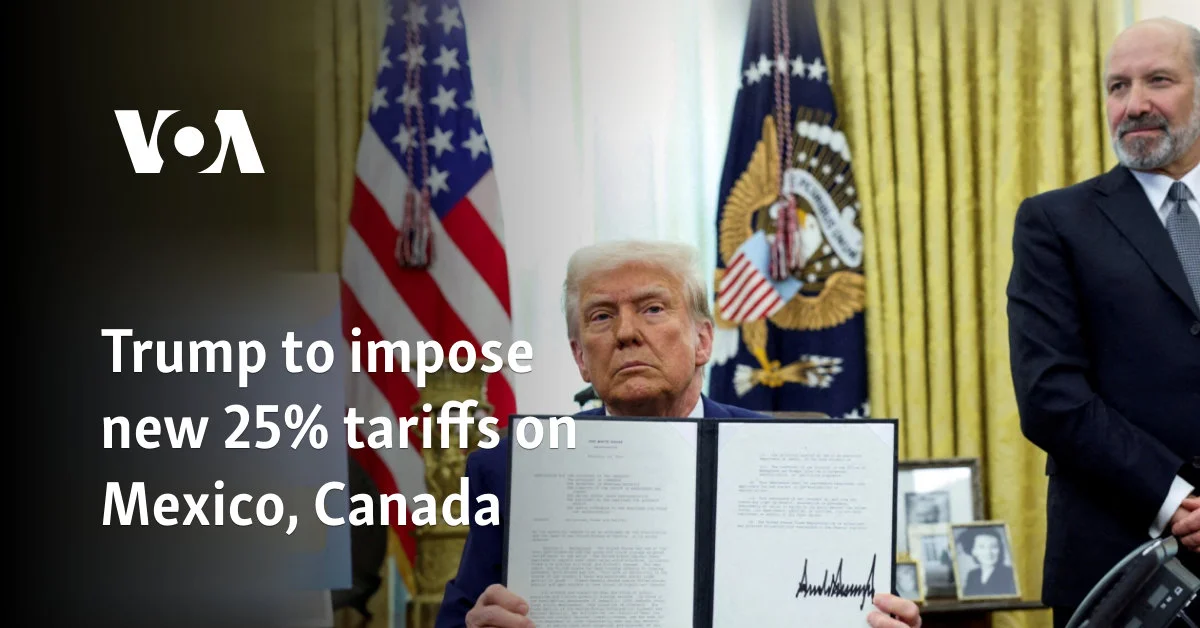

The United States imposed new 25% tariffs Tuesday on exports from its two biggest trading partners, Mexico and Canada, ignoring evidence that the neighboring countries curtailed illegal migration and the flow of illicit drugs into the U.S. as President Donald Trump had demanded.

I’ll take “How to raise taxes for the lower classes without them noticing?” for $1200, Alex.

For an over-simplification, let me present 2 people living in a world where most everything is imported and most everything has a 25% tariff applied.

Steve lives paycheck to paycheck. Every penny he earns is spent. On top of his income tax, sales tax, and whatever other tax he pays for the right to purchase or use something, he also pays that extra 25% on everything for tariffs, which goes to the federal government. Just like a tax, but with a different name. On more or less 100% of his income. So, effectively, the tariff is an additional 25% tax on Steve.

Thermadore III, however, is a trust fund type of guy. He flits back and forth between the beach and the golf course, with no real job, and no real contribution to society. He pays a lower income tax rate than Steve on most of his income, because it’s from long term investments rather than money he had to work for. But because he only spends 10% of his income, he only pays the additional 25% tariff on a fraction of his money. 90% of his income is allowed to grow, tariff free, until such time as he decides to pull some extra cash out for another yacht. Which his accountant will probably advise him to purchase through a shell company registered with some country in the Caribbean, thus avoiding the extra tariffs, anyway.

Again, it’s an oversimplification. But placing large tariffs on vast amounts of stuff that normal people must buy is absolutely raising taxes on the little people.

Edit: grammar isn’t supposed to be this difficult